Highlights:

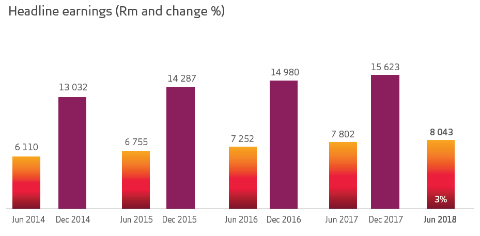

- Headline earnings rose 3% to R8 billion

- Return on equity improved slightly to 16.9% from 16.8%

- Revenue grew 3% to R37 billion

- Operating expenses rose 4% to R20.8bn.

- Cost-to-income ratio deteriorated slightly to 56.2%

- Dividend increased 3% to R4.90 per share

- Pre-provision increased 1% to R16.2bn

Absa Group Limited reported an increase in earnings, revenue and dividend for the first half of 2018 today. The group reported its first set of financial results as `Absa Group’ after being renamed on 11 July this year as it separates from the international Barclays PLC group.

Normalised headline earnings increased 3% to R8 billion compared with the first half of 2017 and income grew to R37 billion. The group will pay shareholders an interim dividend of R4.90 per share, up from R4.75 per share a year earlier.

“Our performance was in line with our guidance and should be considered against the tough macro backdrop in South Africa,” said Jason Quinn, Absa Group financial director. South Africa, which accounts for more than three-quarters of the group’s total earnings, recorded a 2.2% contraction in gross domestic product in the first quarter.

Earnings were boosted by growth in the group’s retail and business banking business in South Africa, its banking business outside of South Africa, and in the wealth, investment management and insurance unit. This was partially offset by a 6% decrease in earnings from the group’s corporate and investment banking business in South Africa.

Well-controlled cost growth of 4% exceeded modest but improving income growth of 3% and resulted in a slightly higher cost-to-income ratio of 56.2%, up from 55.5% in the first half of last year.

The group continues to have solid balance sheet assets of R1.2 trillion (about $90 billion) and strong capital and liquidity levels. The common equity tier 1 ratio of 12.2% is above internal targets and the total group capital adequacy ratio increased to a healthy 15.7%.

*Note: Normalised numbers are presented to adjust for the consequences of the separation and better reflect the Group’s underlying performance.