SmartMobi

SmartPay

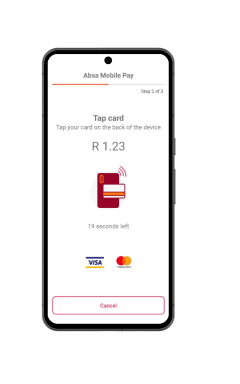

MobilePay

Value Added Services

Our solutions are supported by value added services designed to make running your business easy. Start enjoying these benefits today.

More payment solutions for your business

Merchant Access Online

Intelligence is the new norm. Manage your merchant activities the smart way.

Smart Payment Acceptance Solutions

Speak to our Payment Specialists to find the right merchant solutions for your business.

Merchant Onboarding for ISOs

Simple, quick and reliable online merchant onboarding for ISOs.

Need more help?

For more information visit our Self servicing tools

Contact us:

Call us on: 0860 111 222

Email us at: ContactMerc@absa.co.za