Preserve your capital and increase your income over time

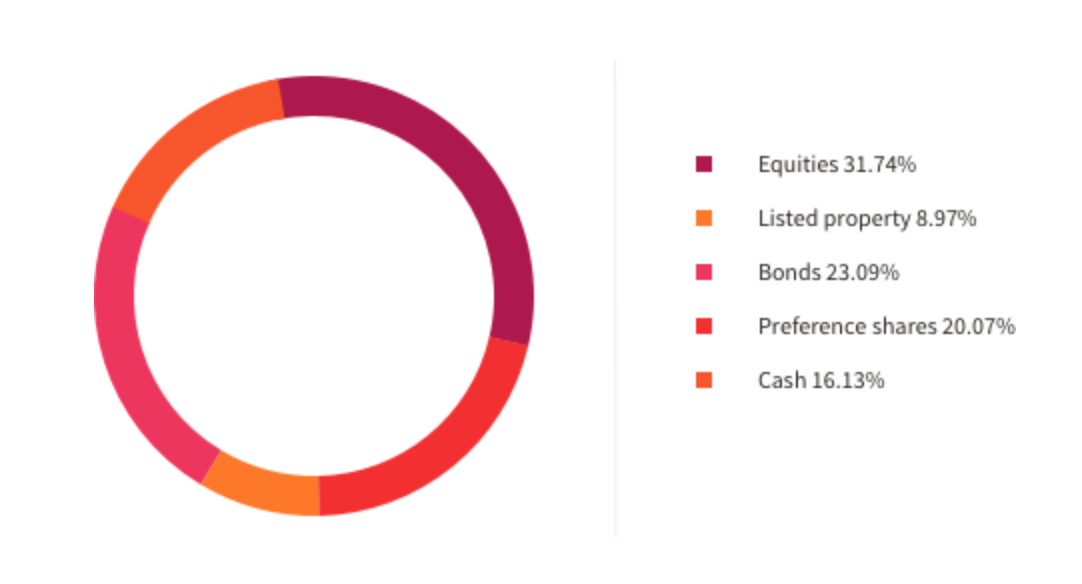

A lower risk portfolio with approximately equal portions of equities, fixed interest cash (bonds and money market instruments), listed property and prime-linked preference shares to maintain your capital value in real terms while generating income.

Minimum investment amount: R1 000 000

Risk profile: Medium

Recommended minimum term: 3 years+

Performance target: CPI inflation +4%

Income: Reinvested or paid out at client’s discretion.

Initial fee: 0.00% - 3.00% (Adviser)

Nil (Management)

Annual fee: 0.60% (Adviser)

0.60% (Management)

Brokerage: 0.40% per transaction

(All fees include VAT)

Strategic Asset Allocation

Top shareholdings

- Growthpoint

- Redefine

- SA Government bond R186

- SA Government bond R213

- SA Government bond R2023

- Sygnia Itrix World

- Investec pref

- Nedbank pref

- Standard Bank pref

- FirstRand pref

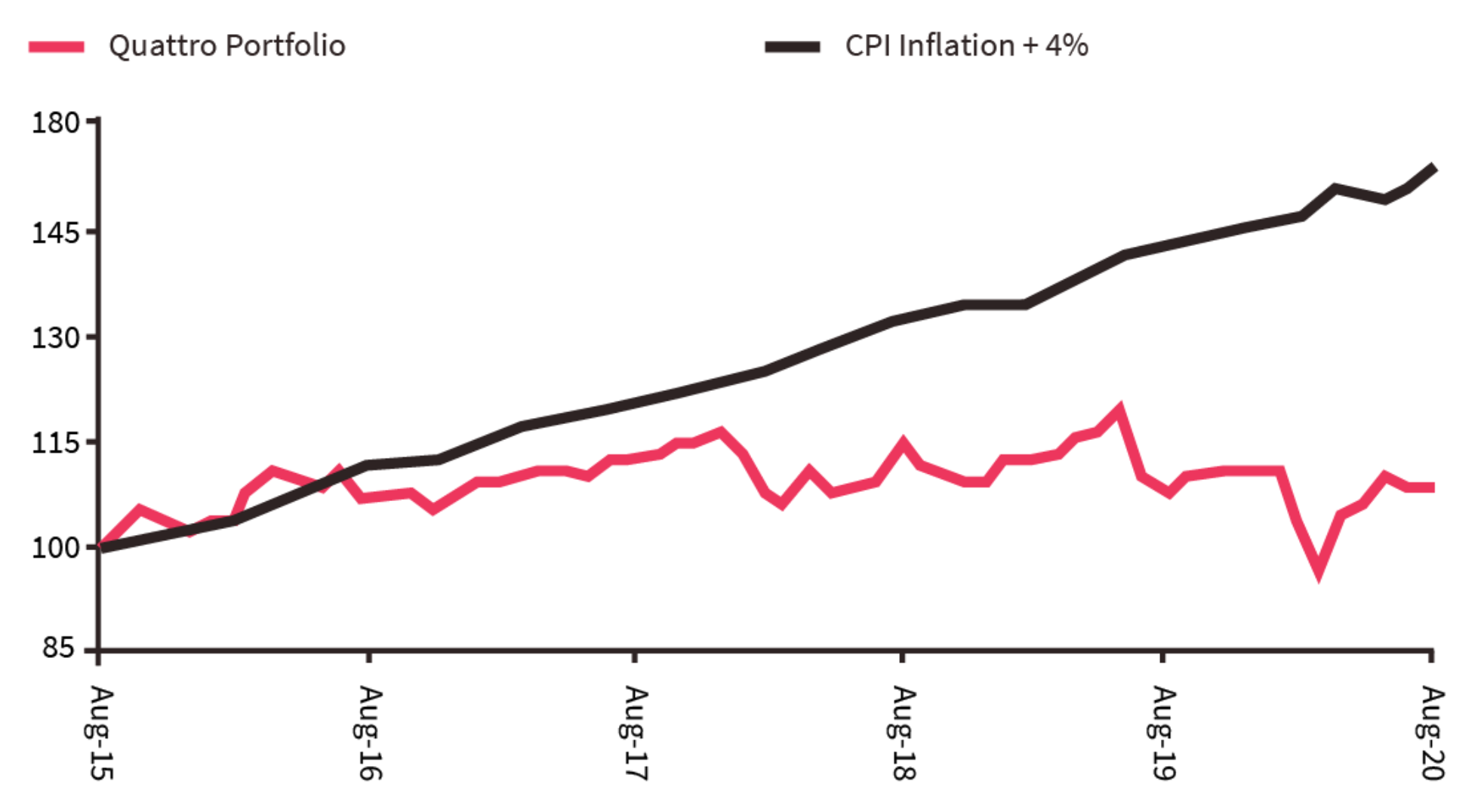

Historical performance

1 year |

3 years |

5 years |

|

| Global Equity portfolio (after fees) | -7.80% | -1.20% | 1.30% |

| CPI inflation +4% | -13.45% | -0.83% | 1.82% |

Please refer to the Disclosure section below for further information on fees and costs.

Cumulative performance (over last 5 years)

The chart reflects the value (monthly data points) of a R100 investment made on the 01 August 2015

Effective annual cost

Charges |

1 year |

2 years |

5 years |

10 years |

| Investment management | 1.59% | 1.09% | 0.99% | 0.91% |

| Advice | 0.00% | 0.00% | 0.00% | 0.00% |

| Other | 0.47% | 0.47% | 0.47% | 0.47% |

| Effective annual cost | 2.06% | 1.56% | 1.46% | 1.38% |

Disclosure and FAIS notice

This information (together with any associated verbal presentation) (this “document”) is provided on the express understanding that the information contained therein shall be regarded and treated as proprietary to Absa Stockbrokers and Portfolio Management (“SPM”) and shall not be regarded as research material of any kind and is for illustrative purposes only. This document shall not be reproduced without the prior written consent of SPM. This information shall not be used, in whole or in part, for any purpose other than for the consideration of the information set out therein. This information has been prepared solely for information purposes and accordingly does not constitute an offer, a solicitation of an offer, invitation to acquire any security or to enter into any agreement, or any advice or recommendation to conclude any transaction (whether on the indicative terms or otherwise) nor does it create any liability or obligation on the part of SPM and must not be deemed as such. Neither SPM, nor any affiliate, nor any of its respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential damages or loss arising from any use of this document and its contents.

Any information, illustrative prices, technical views, disclosure materials or analyses provided to you have been prepared on assumptions and parameters that reflect good faith determinations by SPM and do not constitute advice by SPM and should not be relied upon as such. The information, assumptions and parameters used are not the only ones that may reasonably have been considered and therefore no guarantee is given as to the accuracy, completeness, or reasonableness of any such information, quotations, disclosure or analyses.

The past performance of any securities or other products is not an indication of future performance. No representation or warranty is made that any indicative performance or return indicated will be achieved in the future. Any transaction or agreement to perform certain services that may be concluded pursuant to this document and/or any associated verbal presentation shall be in terms of and confirmed by the signing of appropriate documentation, on terms to be agreed between the relevant parties. Prospective investors should obtain independent advice in respect of any product detailed in this document as SPM provides no opinion or advice including investment, tax, exchange control regulations or legal advice and makes no representation or warranty about the suitability of a product for a particular client or circumstance.

Transactions described in this document may give rise to substantial risk and are not suitable for all investors. This information is to be used at own risk and SPM makes no representation with regards to the correctness of the information herein. By accepting this document, you agree to be bound by the terms, conditions and limitations set out herein. The views in this document are those of SPM and are subject to change, and SPM has no obligation to update its views or the information as contained in this document.

Absa Stockbrokers and Portfolio Management (Pty) Limited is a Member of the JSE Equity Market, Registered Credit Provider Reg. No. NCRCP68, and an Authorised Financial Services Provider with FSP No 45849. Absa Stockbrokers and Portfolio Management (Pty) Ltd is a wholly owned subsidiary of Absa Group Ltd (“Absa”) and complies with Absa's privacy and security policies. However, business is conducted directly with Absa Stockbrokers and Portfolio Management (Pty) Ltd.

Other available investment portfolios

Balanced Portfolio

This portfolio invests in a core of large South African companies to provide long-term growth, giving you a balance of long-term growth with reliable yields.

Global Equity Portfolio

This fund invests offshore which makes this an ideal vehicle for longer-term investors seeking access to global blue-chip equities. This fund is suitable for investors who can accept that price volatility comes with investing in the equity markets and that with high risk comes high reward.

Equity Portfolio

A traditional portfolio structure almost fully invested in FTSE/JSE-listed equities. A well-diversified fund with the objective of exceeding the FTSE/JSE All Share Index over the longer term.